Pradhan Mantri Jan Dhan Se Jan Suraksha Yojana

You would be happy to know that in a very short period of time, several people have enrolled under these schemes; indicating the trust they have reposed in the Govt. Yet, a lot of people remain excluded from social security cover due to insufficient awareness and lack of knowledge about the schemes.

You are a part of a community that commands immense respect in society. You sow the seeds of India’s bright future and mold generations to become good citizens.

Thus, I seek your support and participation in reaching out to people around you about these social security schemes and explaining the benefits that come with these schemes.

I urge you it begin with your immediate family and neighborhood. If you have not already enrolled for these schemes, please do so at the earliest. Inspire your family members and colleagues to also enroll themselves.

The benefits are several and long-lasting. The sooner one enrolls, the better it is. Therefore, please inspire the youth and community members to show the way forward as far as enrollment is concerned.

All details and application forms are available on www.jansuraksha.gov.in. Those keen to enroll simply need to approach their bank branches to subscribe.

The form is simple and includes auto-debit instructions for deduction of premium/contributions from their bank accounts. The process is truly very easy.

Hope you will rise to the occasion and dedicate yourself to this cause of nation-building and ensure that the people of India, especially the poor and the marginalized have a bright future.

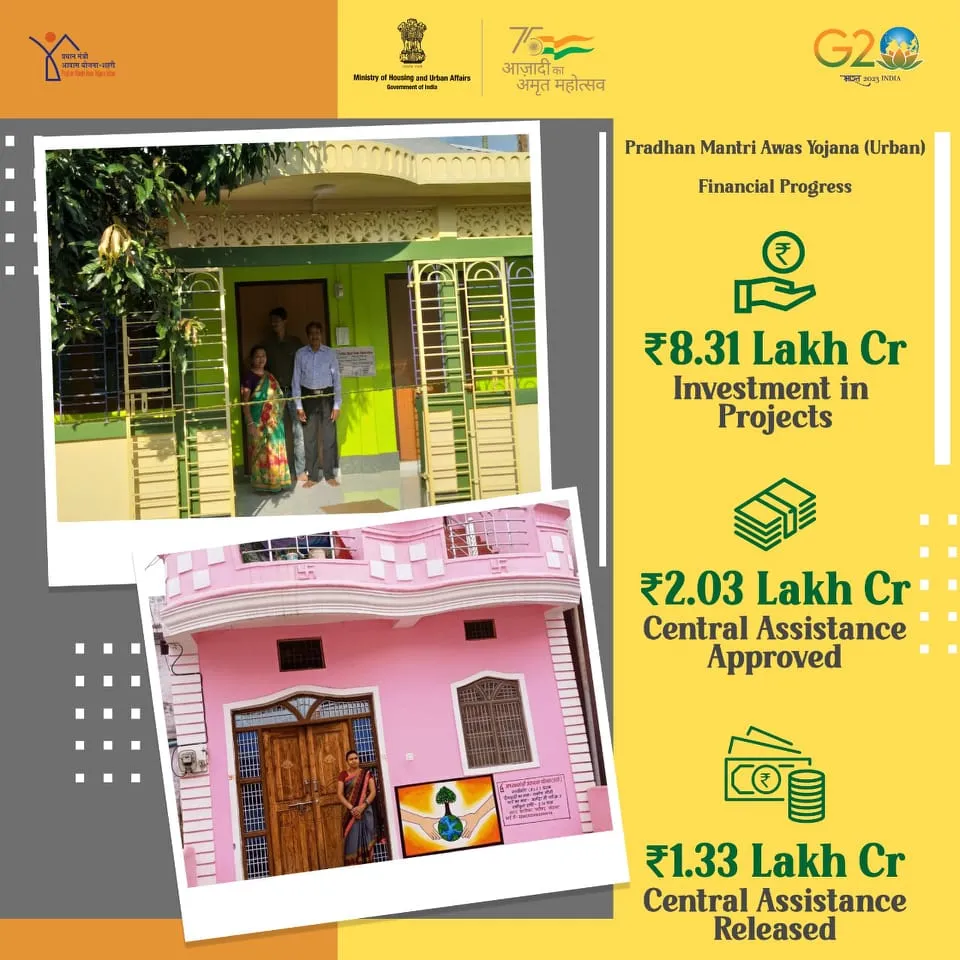

Jan Dhan Yojana Details:

- Department: Ministry of Finance

- Schemes Name: Jan Dhan Se Jan Suraksha Yojana

- Toll-Free No: 1800-110-001 or 1800-180-1111

- Website: www.jansuraksha.gov.in

The government of India has recently introduced 3 comprehensive schemes and social security schemes offering insurance and pensions to all eligible Indians.

- Pradhan Mantri Jeevan Bima Yojana

- Pradhan Mantri Jeevan Jyothi Bima Yojana

- Atal Pension Yojana

All these schemes have been initiated with an aim to bring a qualitative change in the lives of the people of India, particularly the poor.

Pradhan Mantri Jeevan Bima Yojana:

Accident insurance worth Rs.2 lakh at just Rs.12/- PA. For all Bank account holders whose age is between 18 to 70 years and this accident insurance also covers permanent disablement due to accident. Period of insurance, Annual: 1st June – 31st May.

Pradhan Mantri Jeevan Jyothi Bima Yojana:

Life insurance worth Rs.2 lakh at just Rs.330/- PA. For all Bank account holders whose age is between 18 to 70 years and this life, insurance amount goes to your family, after you. Period of insurance, Annual: 1st June – 31st May.

Atal Pension Yojana:

Minimum Investment, Maximum Benefits during old-age. Fixed monthly pensions from Rs.1000/- to Rs.5000/- depending on the contributions.

The Eligibility Criteria for the Scheme are:

- Should be an Indian resident and the age must be 18+

- Should have a savings account with any bank in India, from which the premiums would be automatically debited.

- Applicant must provide his/her Aadhaar card and regular KYC documents when applying.

- He/She must register their mobile with the bank holding their account.

Important Links:

PDF of Pradhan Mantri Yojana:

| Visit here for Jeevan Jothi Bima Yojana |

| Visit here for Suraksha Bima Yojana |

| For Atal Pension Yojana |

Previous Post

Previous Post Next Post

Next Post